The Financial Folly of the Biden Administration

Not everything done by President Biden has been particularly reasonable or popular. One such befuddling policy was the administration’s plan for student loan forgiveness.

October 11, 2022

Being a committed Democrat and a moderate liberal, I have admired some of the remarkable achievements the Biden administration notched this summer—decisive, bipartisan action was taken to alleviate our nation’s growing problem with gun violence, major funding was passed to help rebuild America’s crumbling infrastructure and to combat the climate crisis, and the swearing in of the first Black woman to our nation’s Supreme Court capped off a particularly lively summer in Washington. But not everything done by President Biden has been particularly reasonable or popular. One such befuddling policy was the administration’s plan for student loan forgiveness. This policy upsets fiscal moderates like myself who see it as a regressive bailout to irresponsible debt holders that places their burden on the rest of the country.

The Biden-Harris administration’s student loan debt relief plan, as its full title suggests, is a program to offer relief for college-educated Americans with outstanding loans held by the federal government. The plan offers relief of up to $10,000 for borrowers making less than $125,000 annually, or $250,000 annually if married and filing taxes jointly. The relief amount increases to $20,000 if the borrower received a Pell Grant. This nationwide loan forgiveness program, according to the Wharton School at UPenn, is estimated to cost taxpayers anywhere from $469 billion to $519 billion over the next ten years. This is a problem. The proposal does not account for disproportionate need among those with their debts forgiven, nor does it account for the future earning potential of newly graduated college students. It is an overly simple approach to an extraordinarily complicated problem that fails to offer aid or comfort for those who paid off their college loans or those who worked hard to receive merit-based aid.

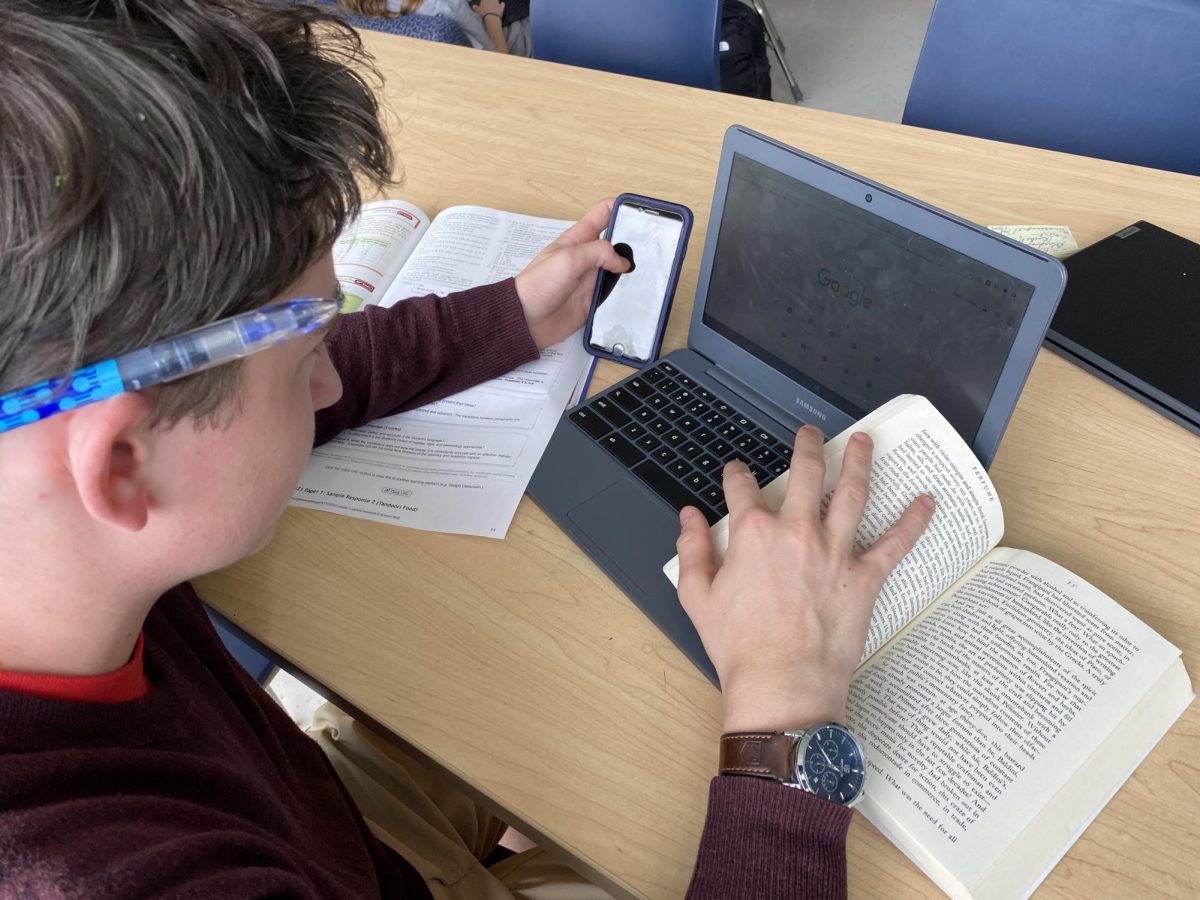

As a high school senior and college applicant, I am limiting myself to colleges that I believe will give me significant merit-based aid because I want to make the responsible financial decision and graduate with little to no debt. To see the Biden administration offer a slapdash debt relief program that does nothing to assist future college attendees or reconcile with the aforementioned injustices is disheartening, not only to the author of this column but to the general public– 64% of Americans oppose student debt cancellation if it raises taxes, and it is hard to see where else the Biden administration will find the extra $500 billion to fund the program. While the program may help to beat away accusations that candidate Biden promised more than he could actually deliver to voters, as his campaign platform originally stated an intention to erase all federally held student debt, it fails to make actual economic or practical sense. Biden is currently fighting record-setting inflation by having his Federal Reserve impose sharp interest rate increases, forcing the rest of the global economy to pay more to develop their economies coming out of the COVID recession. To then turn around and inject more dollars into an overheating economy by forgiving debt for individuals with a high capacity to earn and spend is foolish.

The Biden administration is moving towards a midterm election on which the balance of their power in the legislative branch rests. The need to maintain a popular policy agenda that demonstrates the Democratic party’s capacity for dynamism is more pressing as we inch towards the election, which is why the President’s silly foray into education debt policy is so disappointing. This writer hopes that, moving forward, the administration will govern with all of America in mind.

Michael Shapiro • Oct 13, 2022 at 9:18 am

This is gas